America Runs On Credit

You may have seen this viral news clip making the rounds on the internet this week. The video, shot in 1993, is documenting the first time the phrase “cash or credit” was introduced at Burger King.

“I think it's pretty bad if you have to use a credit card at a fast food restaurant, for something as little as $3.10,” said one patron. “If I use my GM card I get a 5% rebate. If I eat here long enough I'll be able to buy a pickup truck!” said another. (I would have loved to see his face the first time he learned about credit card points.)

There is a lot to takeaway from this 60 second clip. First, the fact that you could buy a meal at Burger King for $3.10. Second, that people were afraid credit cards would slow things down, not speed them up. Next time you’re out, try comparing the speed of Apple Pay against a cashier trying to count out your change in 2023. And third, the reality of just how much our relationship with credit cards, and how we view credit, has changed in the last three decades.

The State of Personal Finance Today

To illustrate how dramatic this change has been, here are just a few of the personal finance headlines from my newsfeed in the past weeks:

47% percent of consumers are carrying credit card debt from month to month

Majority of Americans still rate personal finances as “only fair” or “poor”

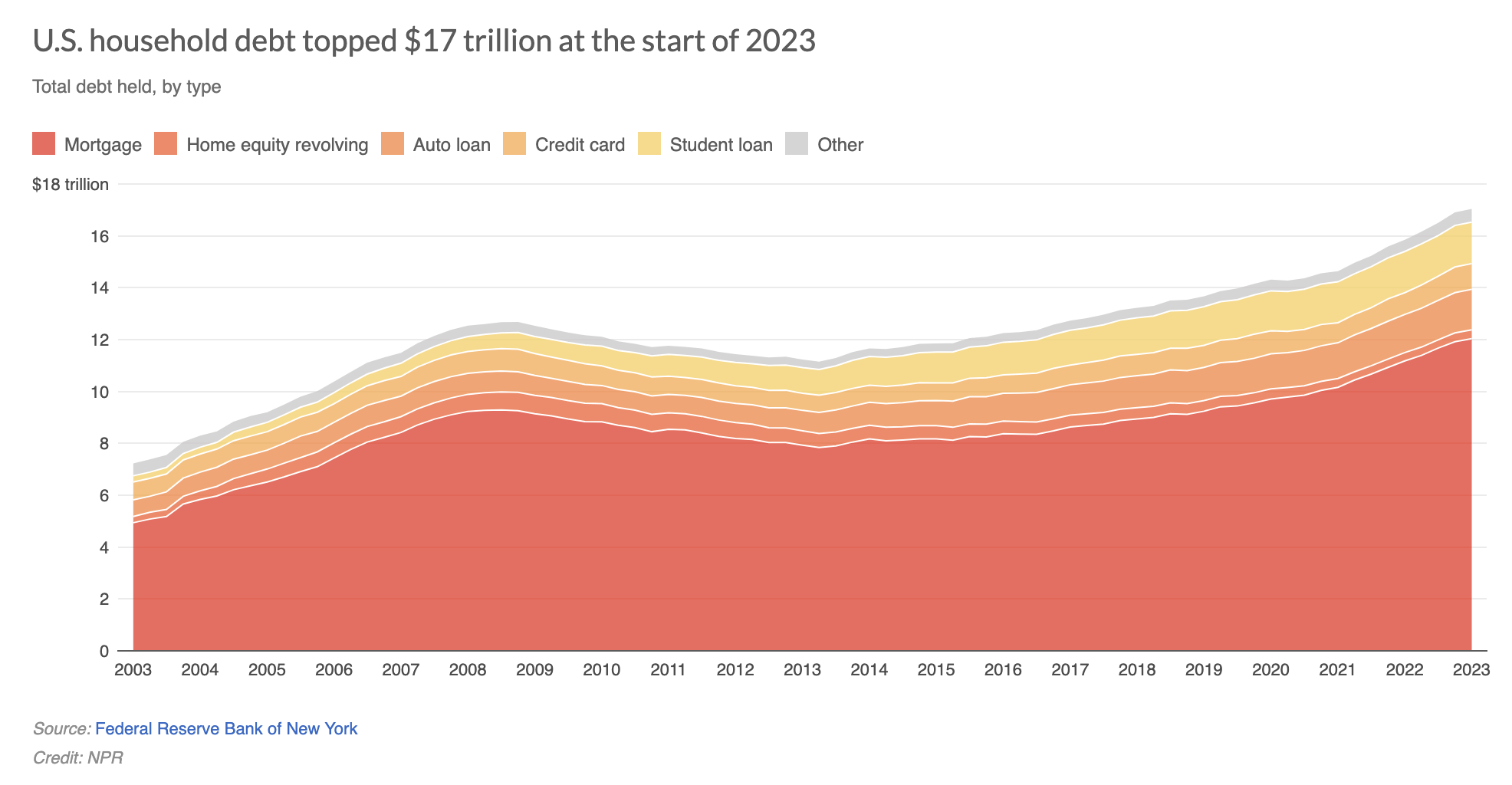

In summary, 2023 presents a grim portrait of personal finance. Americans seem to have mastered the art of accumulating more debt while simultaneously being less prepared for emergencies and retirement, and they are stressed about it. But how did we get here?

Looking at the post-pandemic landscape in front of us, it's easy to blame (1) high interest rates, (2) inflation, and (3) escalating housing costs amid stagnant wages as the source of the problem. Yet, plenty of us (myself included) were still living paycheck to paycheck before a dozen eggs cost nearly $6.

Setting The Stage For The Societal Shift

It’s no secret that Americans thrive on consumerism. We often have the highest rates of consumer spending and credit card usage around the world, while simultaneously having lower household savings compared to other developed countries. To get a better understanding of why this is, let's look back to before the introduction of “cash or credit” to understand exactly how we went from a society of savers to a society of spenders.

The factors that led us to the headlines listed above came together in a near perfect storm. Post WWII and the Great Depression, the U.S. was entering an economic boom, and many Americans were experiencing consumer optimism for the first time. The introduction of consumer loans, and eventually credit cards, only served to further people’s ability to quite literally buy into the concept of an “American Dream” and “keeping up with the Joneses.”

On the backdrop of boosted consumer spending was the erosion of wages, which remained stagnant even though the cost of living and goods continued to rise. Less and less schools were offering financial education, and for those of us who did learn how to balance a checkbook in grade school, by the time we were old enough to open our own account, no one was using checks anymore!

Do Americans Want To Be Better?

Looking at the data above, it’s easy to paint a portrait of a society of people who are reckless and irresponsible with their money. Are we simply lazy, or is there something bigger at play? Personally, I believe Americans want to be better but haven’t been educated on how.

A 2018 study by GuideVine (now Avantax) found that less than half of the 1,000 participants could explain what a 401(k) is. Only 13% of them had a 5-year plan for their finances, and just a third of participants could envision a life where they were not in some kind of debt. In 2023, only 21 states require high school students to take a course in personal finance. When I read these figures, I don’t see people who are lazy; I see people forced to confront a financial and educational system working against their success.

The Personal Finance Movement

A lack of formal education around personal finance has compelled many young people, namely Millennials and Gen Z, to learn about finance on their own. The increasing popularity of personal finance books, blogs (like this one), and courses offering financial advice, not to mention budgeting and finance related apps, reflect a growing desire and need for financial literacy among Americans.

In the last few years, we have seen an endless number of 'Finfluencers', or personal finance influencers, join in on the movement. It feels like every few months a new personal finance hack goes viral on TikTok, from curbing overspending through "cash-stuffing" to justifying overspending with "girl-math."

While we would all be well-advised to be careful whom we take financial advice from, I think the message is clear: Americans want to be better with their finances; but we are long overdue on addressing the systemic failures that prevent this aspiration from turning into action.